Banking as a Service is revamping the banking value chain and thus building new propositions.

What is BaaS Opportunity?

BaaS is an innovative B2B service allowing banks to lease their infrastructure to their clients such as big holdings, retailers, fintech startups, and any other organization that wish to carry out finance operations but are not willing to get involved in organizing their own bank.

The BaaS model is similar to renting cloud resources from third-party providers, the “lessees” themselves choose what tools to use, and in turn, bank offers them a wide range of services like license, payment processing, card issuance, information security, limit management system, real-time cash flow logic and etc.

Using these tools, the BaaS user can perform banking operations in their app. For example, they can implement balance checks, online payments, history views without any direct interactions with the bank.

To elaborate on the issue, we can pinpoint some features of Baas as follows:

- Banking as a Service (BaaS) is the provision of banking products and services through third-party distributors

- By integrating non-banking businesses with regulated financial infrastructure, BaaS offerings are enabling new, specialized propositions and bringing them to market faster

- These new propositions, built on specificity and agility are displacing existing offerings, disaggregating many profitable elements of the traditional banking value chain in the process

SaaS Banking (BaaS) and Open Banking

In financial services, Banking-as-a-Service (BaaS) platform has emerged as a key element of open banking, in which firms provide more financial clarity options for account holders by opening their application programming interfaces (APIs) to third parties to develop new services.

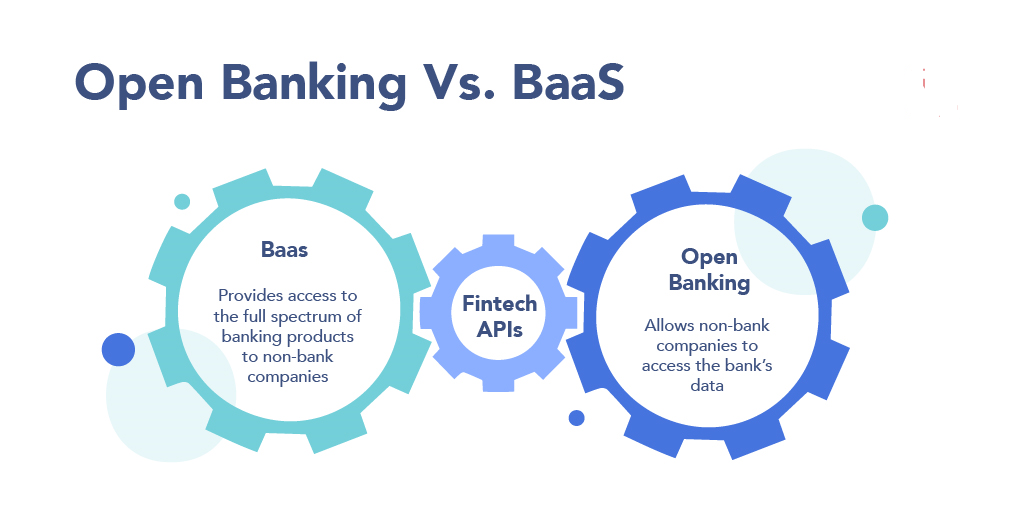

To give more details, BaaS is an innovative B2B service allowing banks to lend their infrastructure to their clients such as big holdings, retailers, fin-tech startups, and any other organizations that wish to carry out finance operations but do not want to organize their own bank. while Open banking is similar to BaaS because of leasing banking services to non-bank organizations, two models are suitable for different purposes. though BaaS allows firms to offer pure banking products via their interface, open banking is used to grant access to clients’ data (with their consent) without transferring banking functions.

Open banking is a part of the open innovation model. It develops with growth of technology and changing viewpoints about ownership of user data.

Banking as a Service (BaaS) Vs. Open Banking

While companies can offer various banking products with the Bank as a Service model, the most advanced financial service that Open Banking offers is the one-off payment. One-off payments are defined as non-recurring payments between the company and the customer.

It is important to note that Open Banking does not allow businesses to take deposits or lend money, as they need a banking license to offer these services. However, as technologies and legislations are constantly changing, there are upcoming use cases for Open Banking, such as instant account top-up and instant bank payments.

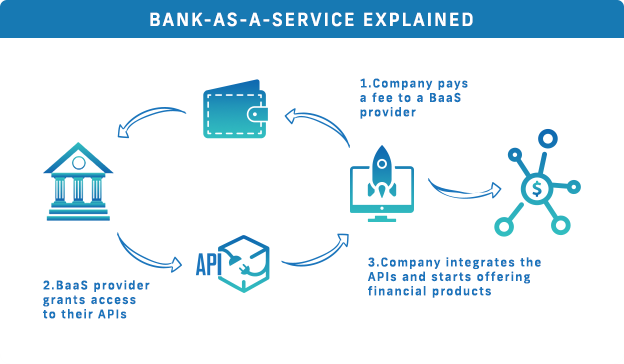

How does banking-as-a-service work?

The BaaS model begins with a fin-tech, digital bank, or other third-party providers (TPP) paying a fee to access the BaaS platform. financial institutions open their APIs to the TPP, by which they grant access to the systems and information necessary to build new banking products or offer white label[1] banking services.

In addition to getting ahead in open banking, legacy institutions that launch their own BaaS platforms are also opening up new revenue streams. The two main monetization strategies for BaaS include charging clients a monthly fee for access to the BaaS platform or charging a la carte for each service used.

[1] White label banking is another term for private label financial services or banking-as-a-service (BaaS), in which banks open up their application program interfaces (APIs) to let third parties build their own financial products with existing infrastructure.

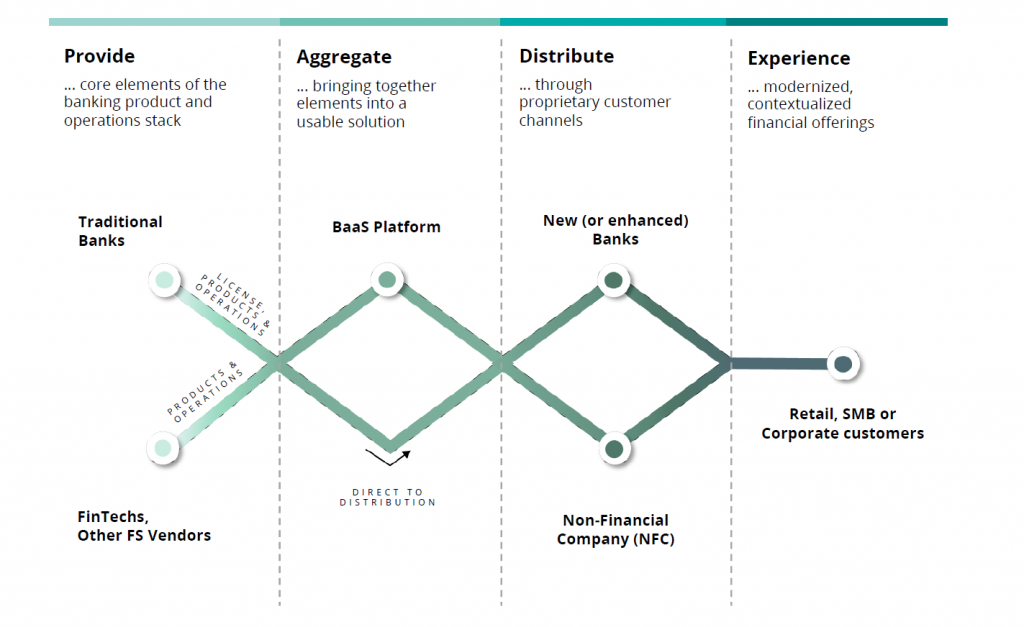

BaaS Value Chain

Banking as a Service (BaaS) is reconfiguring the banking value chain by enabling third-party distributors to offer banking products and services. Banks in particular are integrating fin-tech or other financial service vendor products into the banking journey, while non-financial companies are embedding banking products into their own services.

BaaS Value Chain

Evolution of Banking as a service

The growth of Banking-as-a-Service model is facilitating value creation as well as value exchange between both financial and non-financial entities, with the consumer being the very first beneficiary.

The World Retail Banking Report found that two-third of financial institutions are currently using a BaaS platform, with 25% stating that a BaaS platform is in the planning or development stage.

As Jim Marous the co-publisher of The Financial Brand, host of the Banking Transformed podcast and owner/CEO of the Digital Banking Report mentions: “The key to survival in 2021 and beyond is to embrace the change that we are experiencing and plan for the long-term with data, advanced analytics, fast and easy digital functionality, and revised back-office processes that reflect a digital future.”

Banking as a Service (BaaS) Evolution

Banking as a Service Industry Outlook

A number of countries have already Started introducing open banking regulations, suggesting that the financial services industry is moving towards the age consumers’ new expectations such as shared data and infrastructure.

The well-informed legacy banks that create their own BaaS platforms, will not only advance through the open banking opportunity before their competitors, but also open up a new stream of revenue by monetizing their platforms.

In the UK, the new revenue potential generated through open banking-enabled small- and medium-sized business and retail customer propositions was £500 million ($700 million) in 2018, per PwC — and Insider Intelligence expects that to grow at a 25% compound annual growth rate to reach £1.9 billion ($2 billion) by 2024.

Figure 4 Factors that enable BaaS

Gathered and composed by: Forough M.Salehi

- “How the banking-as-a-service industry works and BaaS market outlook for 2021”, by: Shelagh Dolan, July 20, 2021

- “Banking as a Service Explained”, Deloitte Consulting LLP, by: Andrew Cowley, Tim O’Connor, Neil Malani, Gys Hyman: , July 2021

- “Banking as a Service vs. Open Banking vs. Platform Banking. What Are They and What Are They Not?”, Maryna Cherednychenko, April 23, 2021:

- Bank as a Service and Open Banking Models Explained, SEPA Cyber Technologies

- “The Evolution of Banking: 2021 and Beyond”, by: Jim Marous

میانگین آرا: 0 / 5. شمارش رایها: 0